Introduction: Why the Stock Market Matters in the USA

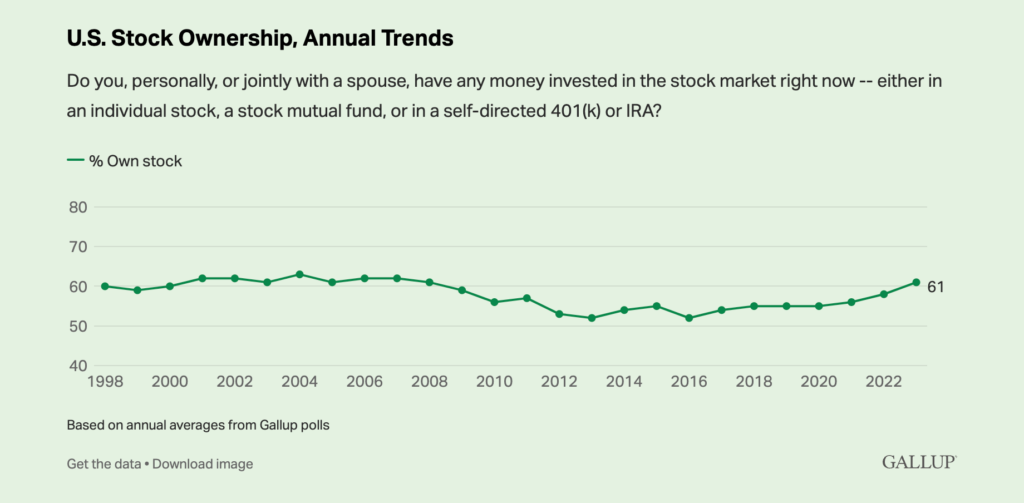

The stock market has always been at the center of the American economy. For millions of U.S. citizens, it represents more than just a place to buy and sell shares—it’s the backbone of retirement planning, wealth building, and business growth. Whether you are an experienced investor or someone just starting your financial journey, understanding the stock market is essential in today’s world. In fact, surveys show that nearly 60% of Americans own stocks directly or through retirement accounts, making it one of the most common forms of investment in the United States.

This article will walk you through the history, structure, opportunities, risks, and future of the U.S. stock market. By the end, you’ll have a complete understanding of how it works and how you can use it to strengthen your financial future.

A Brief History of the U.S. Stock Market

The United States has one of the oldest and most developed financial markets in the world. The New York Stock Exchange (NYSE) was founded in 1792 when 24 brokers signed the Buttonwood Agreement under a buttonwood tree on Wall Street. Since then, the NYSE has grown into the largest stock exchange globally, with a market capitalization of over $30 trillion.

In 1971, the NASDAQ was launched, becoming the world’s first electronic stock exchange. Unlike the NYSE, which used physical trading floors, NASDAQ pioneered electronic trading, making it a hub for technology companies like Apple, Microsoft, and Amazon.

Over time, the U.S. stock market has experienced ups and downs:

- The Great Depression (1929) caused massive losses and shaped regulations.

- The Dot-com Bubble (2000) saw tech stocks soar and then collapse.

- The 2008 Financial Crisis revealed risks of housing and banking sectors.

- The COVID-19 pandemic in 2020 triggered record volatility, followed by one of the fastest recoveries in history.

These events show that while the market can be risky, it has always recovered and continued to grow in the long term.

How the Stock Market Works

At its core, the stock market is a platform where companies raise money by selling ownership shares, and investors buy those shares in hopes of making a profit.

- Stocks (or shares): Represent ownership in a company. If you own Apple stock, you technically own a small piece of Apple.

- Primary market: Where companies issue new shares through Initial Public Offerings (IPOs).

- Secondary market: Where investors trade existing shares on exchanges like NYSE or NASDAQ.

Stock prices are determined by supply and demand. If more people want to buy a stock, its price goes up. If more want to sell, its price goes down. Market forces, company performance, economic conditions, and even investor psychology all play roles in shaping these prices.

Major U.S. Stock Market Indexes

To measure the performance of the U.S. stock market, investors often look at indexes—collections of selected stocks that represent a portion of the market.

- S&P 500 – Includes 500 of the largest U.S. companies. Considered the best representation of the overall market.

- Dow Jones Industrial Average (DJIA) – Tracks 30 major U.S. companies, such as Coca-Cola, Boeing, and Goldman Sachs.

- NASDAQ Composite – Focuses heavily on technology and growth companies, including Apple, Tesla, and Google.

These indexes not only reflect the health of the market but also guide many investment strategies. For example, when people say “the market is up,” they usually mean the S&P 500 or Dow Jones has risen.

How Americans Invest in the Stock Market

There are several ways Americans participate in the market:

- Individual Investors: People who buy and sell stocks directly through online brokerages like Robinhood, Fidelity, and Charles Schwab.

- Retirement Accounts (401k, IRA): Many Americans invest in the stock market indirectly through employer-sponsored retirement plans. Contributions are often invested in mutual funds or ETFs that hold a variety of stocks.

- Mutual Funds & ETFs: These allow investors to buy a collection of stocks in a single investment, providing diversification and reduced risk.

- Robo-Advisors: Automated platforms like Betterment and Wealthfront make investing easy by managing portfolios with algorithms.

Stock Market Strategies for U.S. Investors

Different investors use different strategies depending on their goals:

- Long-Term Investing: Buying and holding quality stocks for years or decades. This strategy has proven to be one of the most reliable ways to build wealth.

- Day Trading & Swing Trading: Short-term buying and selling to profit from daily or weekly price changes. Risky but popular with active traders.

- Dividend Investing: Choosing stocks that regularly pay dividends, providing a steady stream of income.

- Value vs Growth Investing: Value investors look for undervalued companies, while growth investors focus on fast-growing companies like Tesla or Nvidia.

Risks of Stock Market Investing

While the U.S. stock market has historically provided strong returns, it is not without risks:

- Market Volatility: Prices can swing sharply in short periods.

- Inflation & Interest Rates: Higher interest rates often cause stock prices to fall.

- Company-Specific Risks: Poor management or scandals can sink a stock.

- Global Economic Risks: Wars, pandemics, or oil prices can affect markets worldwide.

The key to managing these risks is diversification—spreading investments across many companies, industries, and asset types.

How to Start Investing in the U.S. Stock Market

For beginners in the U.S., getting started is easier than ever:

- Set Financial Goals: Decide whether you want short-term profits, retirement savings, or wealth building.

- Choose a Brokerage Account: Popular U.S. platforms include Robinhood, Charles Schwab, Fidelity, and E*TRADE.

- Build a Diversified Portfolio: Instead of putting all your money in one stock, spread it across sectors like tech, healthcare, and finance.

- Use Dollar-Cost Averaging: Invest a fixed amount regularly to reduce the impact of volatility.

The Role of Technology in the U.S. Stock Market

Technology has completely changed how Americans invest:

- Mobile Trading Apps: Platforms like Robinhood made investing accessible to millions.

- AI & Algorithmic Trading: Hedge funds and institutions use AI to predict price movements.

- Crypto & Stocks: Some platforms now let investors trade cryptocurrencies alongside stocks.

These innovations have made the market more accessible, but they also raise concerns about overtrading and market manipulation.

Future of the Stock Market in the USA

The U.S. stock market is expected to remain the world’s financial hub, but new trends are emerging:

- AI & Automation: Will continue to shape how markets operate.

- ESG Investing: More Americans are investing in companies that focus on environmental and social responsibility.

- Global Integration: Events in Asia or Europe now affect Wall Street almost instantly.

Experts believe that despite short-term volatility, the long-term growth of the U.S. stock market remains strong, making it an attractive option for investors.

Conclusion: Why Every American Should Understand the Stock Market

The U.S. stock market is more than a place where Wall Street traders make money—it’s a key driver of the economy, a tool for wealth building, and an opportunity for every American to secure their financial future. By learning the basics, understanding the risks, and choosing the right strategy, anyone can participate in the growth of the U.S. economy.

Whether you are saving for retirement, building generational wealth, or simply looking for new opportunities, the stock market offers a pathway. The earlier you start learning and investing, the more you can benefit from the power of compounding and long-term growth.