Introduction: Why Finance Matters for Every American

Finance is more than numbers; it’s the foundation of how Americans live, spend, and build wealth. In the USA, understanding finance means managing daily expenses, preparing for emergencies, investing for retirement, and creating long-term stability. Yet many Americans struggle with financial literacy. According to a Federal Reserve survey, over 40% of U.S. adults cannot cover a $400 emergency expense without borrowing money.

This article will guide you through the essentials of personal finance in America, including budgeting, saving, credit management, investing, taxes, and future financial trends. By the end, you will have a roadmap to improve your financial life in 2025 and beyond.

1. Understanding Personal Finance in the USA

Personal finance refers to how individuals manage money, including income, expenses, savings, investments, and retirement planning. In the U.S., this is even more important because the cost of living, healthcare, and education is high. Good financial planning helps Americans achieve:

- Financial Security – Paying bills on time and handling emergencies.

- Wealth Growth – Using investments to build long-term assets.

- Retirement Comfort – Ensuring stability after leaving the workforce.

2. The Foundation: Budgeting and Saving

Every strong financial plan starts with a budget. A budget is simply a plan for how you will spend and save your money.

Popular Budgeting Methods in the USA:

- 50/30/20 Rule – 50% for needs, 30% for wants, 20% for savings.

- Zero-Based Budgeting – Assigning every dollar a purpose.

- Envelope System – Dividing cash into spending categories.

Importance of Emergency Savings

Most financial experts recommend saving at least 3–6 months of living expenses in an emergency fund. This protects you from unexpected costs like medical bills, job loss, or car repairs.

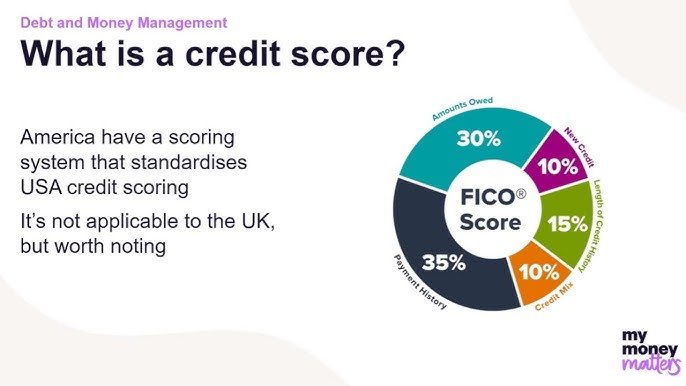

3. Credit Score and Debt Management in the USA

In America, your credit score is one of the most powerful numbers in your life. It determines whether you can rent an apartment, buy a home, or get a loan at a good interest rate.

- Excellent Credit: 720+

- Good Credit: 690–719

- Fair Credit: 630–689

- Poor Credit: Below 629

Common Debt Types in the USA:

- Credit Card Debt – High-interest, short-term debt.

- Student Loans – A major burden for many young Americans.

- Auto Loans & Mortgages – Long-term financing options.

To stay financially healthy, Americans need to pay off high-interest debt first, avoid late payments, and keep credit utilization below 30%.

4. Investing in the U.S. Financial Market

Investing is how Americans grow wealth beyond just saving.

Popular Investment Options in the USA:

- Stock Market – Buying shares of companies. (Many invest through retirement accounts like 401(k) and IRAs.)

- Bonds – Lower-risk investments with steady returns.

- Real Estate – Owning property for rental income or appreciation.

- Mutual Funds & ETFs – Diversified investments managed by professionals.

Retirement Planning in the U.S.

- 401(k) Plans – Employer-sponsored retirement accounts with tax benefits.

- IRAs (Traditional & Roth) – Individual Retirement Accounts that help reduce taxes.

The earlier Americans start investing, the more they benefit from compound interest—earning interest on both the original investment and the accumulated returns.

5. Tax Planning in the USA

Taxes are a crucial part of financial planning. The U.S. tax system is progressive, meaning higher incomes are taxed at higher rates.

Key Taxes Americans Deal With:

- Federal Income Tax

- State Income Tax (in most states)

- Payroll Taxes (Social Security & Medicare)

- Capital Gains Tax on investments

Smart Americans reduce taxes by:

- Contributing to 401(k) or IRA accounts.

- Claiming deductions (student loans, mortgage interest, medical expenses).

- Using tax credits (Child Tax Credit, Earned Income Credit).

6. Insurance and Healthcare Costs in the U.S.

Unlike many countries, healthcare in the U.S. is very expensive. That’s why health insurance is a critical part of personal finance.

- Health Insurance – Covers medical costs.

- Life Insurance – Provides financial security for families.

- Home & Auto Insurance – Protects assets.

Without proper insurance, one medical emergency can wipe out savings.

7. Financial Technology (FinTech) in America

Technology is transforming how Americans manage money.

- Mobile Banking Apps – Chase, Wells Fargo, Bank of America.

- Budgeting Apps – Mint, YNAB (You Need A Budget).

- Investment Platforms – Robinhood, Fidelity, Charles Schwab.

- Robo-Advisors – Betterment, Wealthfront.

FinTech makes finance more accessible, but it also requires caution to avoid scams and overspending.

8. The Future of Finance in the USA

The financial landscape in America is changing rapidly:

- AI & Automation – Smarter investment tools and budgeting apps.

- Digital Payments – Mobile wallets like Apple Pay and Google Pay are replacing cash.

- Cryptocurrency & Blockchain – Becoming more mainstream in American investing.

- Sustainable Investing – More U.S. investors focus on ESG (Environmental, Social, Governance) funds.

Conclusion: Building a Strong Financial Future in the USA

Finance is not just about money—it’s about freedom, security, and opportunity. For Americans, mastering personal finance means balancing income and expenses, managing debt, investing wisely, and planning for taxes and retirement.

The U.S. financial system offers many opportunities, but it also demands responsibility. By learning financial literacy, using modern tools, and planning ahead, every American can achieve financial independence.

The earlier you start, the stronger your financial future will be.

Pingback: Smart Ways to Earn and Build Financial Stability in the USA - Epic Globe Services