Introduction

Financial security is a top priority for millions of Americans today. With rising living expenses, growing debt burdens, and an unpredictable economy, people are seeking smarter ways to earn money and secure their futures. Thankfully, the United States is full of opportunities—both traditional and modern—that can help individuals achieve financial independence. Whether through investments, side hustles, online businesses, or real estate, Americans can find multiple paths to building wealth if they are willing to plan and take action.

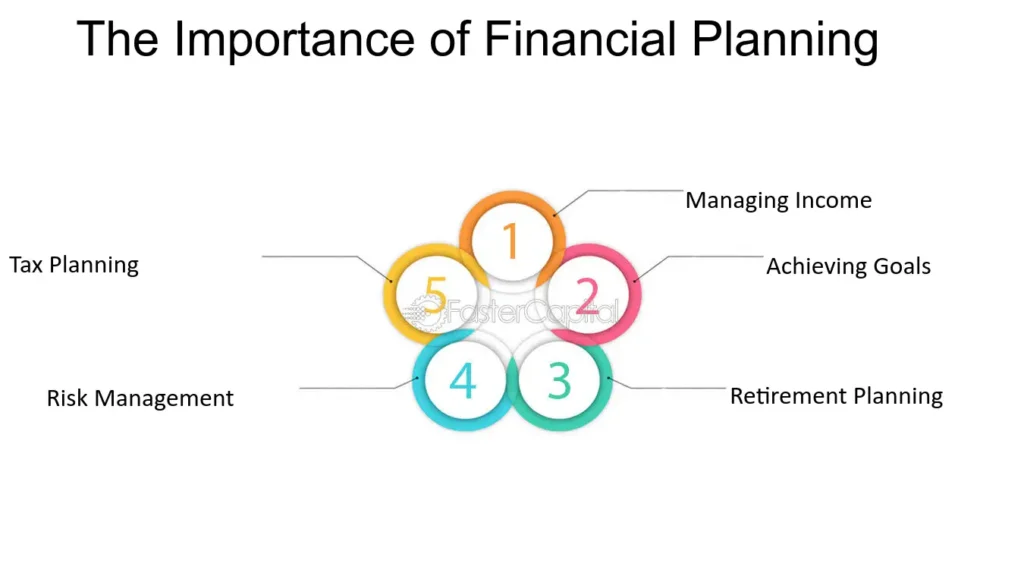

The Importance of Financial Planning

Before diving into earning opportunities, it’s important to start with financial planning. Many Americans live paycheck-to-paycheck simply because they lack a clear budget or financial strategy. A strong financial plan includes tracking income, setting savings goals, managing debt, and investing for long-term growth. Without a roadmap, it becomes difficult to measure progress or avoid financial mistakes. Planning allows individuals to allocate resources effectively, ensuring money is not just earned but also used wisely to build a secure financial future.

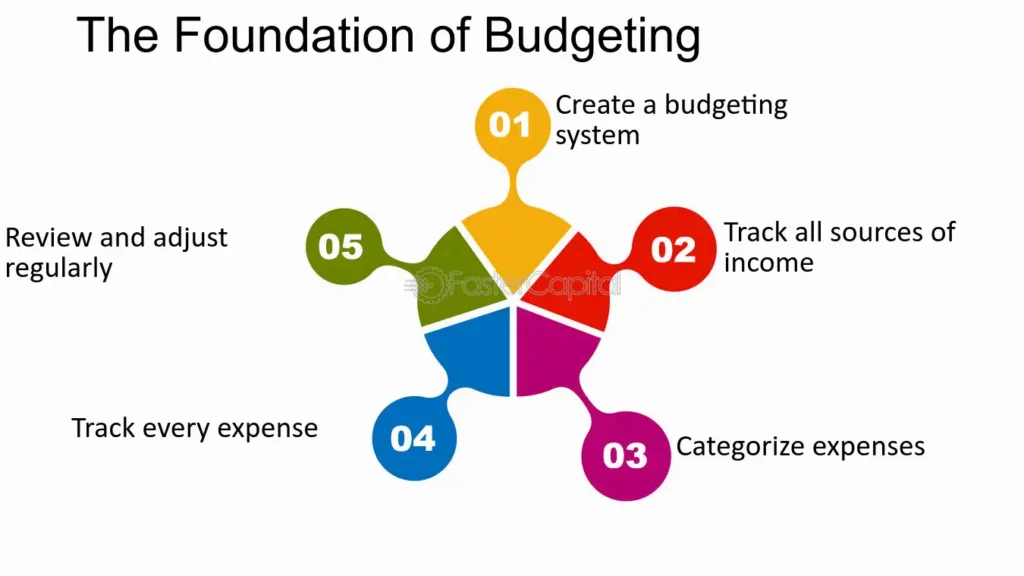

Budgeting as a Foundation

Budgeting is often underestimated but remains the foundation of financial success in the U.S. Creating a budget helps individuals see exactly where their money is going each month. Many financial advisors recommend the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings or debt repayment. With apps like Mint, YNAB, and Personal Capital, budgeting has become easier than ever. When Americans actively track their spending, they gain more control, reduce unnecessary costs, and redirect money toward investments and opportunities.

Emergency Funds for Security

One of the smartest financial moves is building an emergency fund. In the United States, unexpected medical bills, car repairs, or job loss can quickly put families in debt. Experts suggest saving at least three to six months’ worth of living expenses in a high-yield savings account. While building such a fund may take time, it provides peace of mind and reduces reliance on credit cards or loans during tough times. Having an emergency fund creates stability and opens the door to smarter investing.

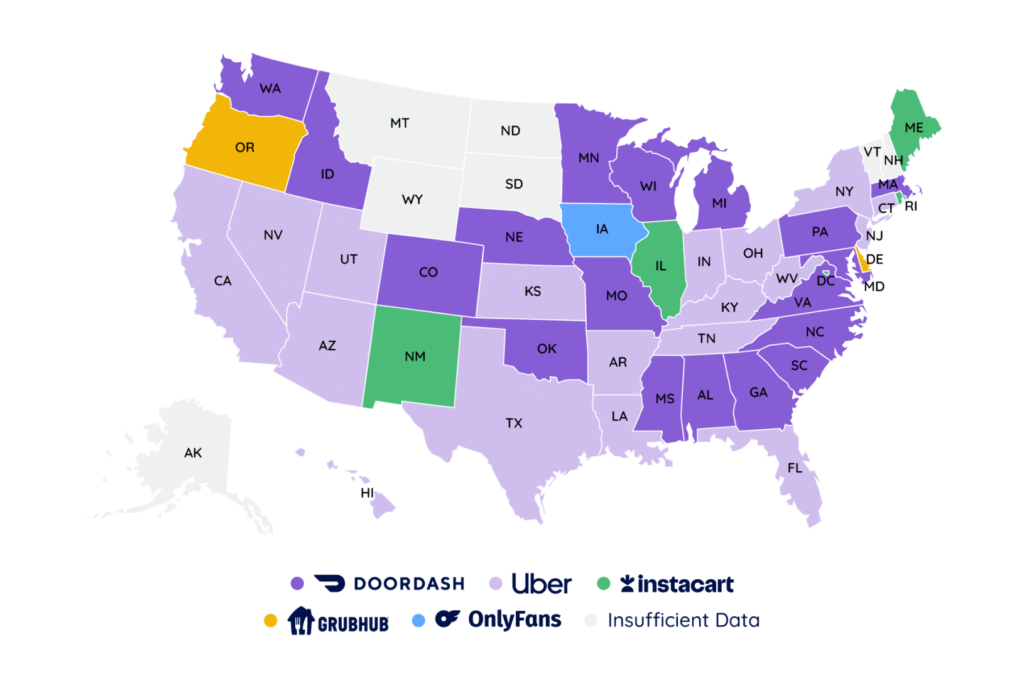

Embracing the Gig Economy

The gig economy has transformed how Americans earn money. Platforms like Uber, Lyft, DoorDash, and Instacart allow individuals to make extra income with flexible schedules. For those with creative or technical skills, freelancing on Fiverr and Upwork has become a profitable path. Many workers are using gig jobs not just as side income but as their primary career. While the flexibility is appealing, gig workers must plan carefully, since they manage their own taxes, health insurance, and retirement planning without employer benefits.

Popular Side Hustles in the U.S.

Side hustles are no longer just optional—they are a lifestyle choice for many Americans. Teaching online courses, tutoring, photography, pet sitting, or even selling crafts on Etsy are popular options. Others are turning to eBay or Amazon FBA for product reselling. A well-chosen side hustle can generate steady income that supplements full-time work. The most successful hustlers focus on areas they enjoy, allowing them to stay consistent and motivated. In many cases, side hustles grow into full-time businesses over time.

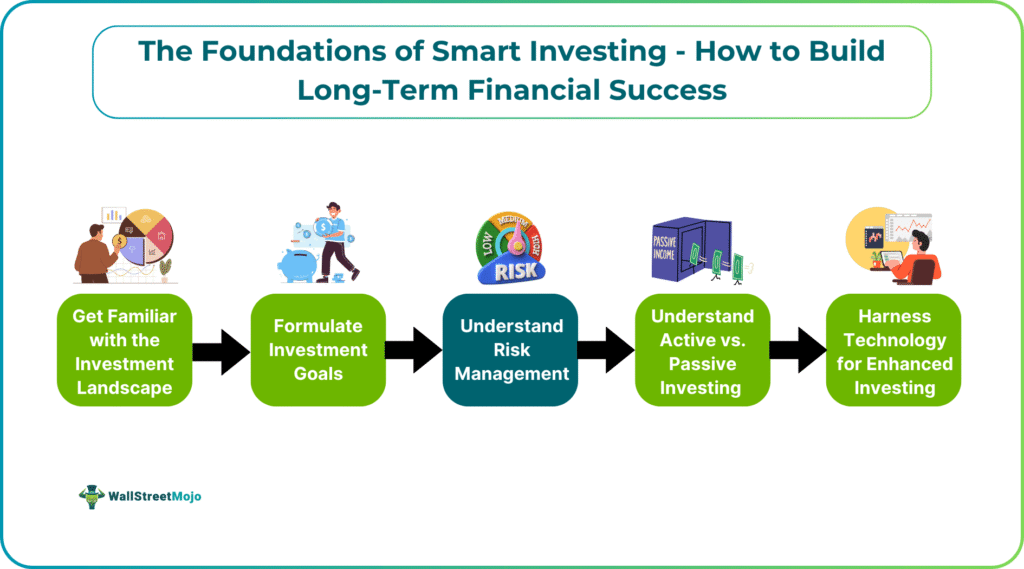

Investing in the Stock Market

Investing is one of the most effective ways to build long-term wealth in the U.S. The stock market has consistently rewarded patient investors with strong returns. With apps like Robinhood, Fidelity, and E*TRADE, investing is accessible to anyone, not just the wealthy. Options include individual stocks, ETFs, and index funds that provide diversification and lower risk. While markets fluctuate, consistent investing with a long-term perspective allows compounding growth to work in your favor. Smart investors avoid speculation and instead focus on steady growth.

Real Estate Opportunities

Real estate remains a cornerstone of wealth creation in America. Buying rental properties can provide passive income while building long-term equity. For those without the capital to buy property directly, REITs (Real Estate Investment Trusts) allow individuals to invest in real estate through the stock market. With housing demand continuing to rise in many U.S. cities, real estate remains a strong long-term strategy. However, successful real estate investors study the market carefully, focusing on high-growth areas where property values are increasing.

Online Business and E-commerce

The rise of digital commerce has made it possible for Americans to build businesses from home. Platforms like Shopify, Amazon, and Etsy allow entrepreneurs to sell products with minimal upfront costs. Digital products such as eBooks, courses, and printables are also becoming popular income streams. The U.S. consumer market is massive, and online businesses can reach millions of buyers with the right marketing strategy. Social media and influencer marketing have made it easier to promote products and build loyal customer bases.

Affiliate Marketing for Passive Income

Affiliate marketing is another growing opportunity for Americans seeking passive income. By promoting products and services online, individuals earn commissions whenever someone makes a purchase through their referral links. This strategy works well with blogs, YouTube channels, and social media pages. The key is choosing products relevant to your audience and building trust through honest recommendations. Many U.S. bloggers and influencers are making full-time incomes from affiliate marketing, showing that consistency and audience engagement are the true drivers of success.

Content Creation and Social Media

Content creation has turned into a major earning opportunity in the U.S. Platforms like YouTube, TikTok, and Instagram allow individuals to build audiences and monetize through ads, sponsorships, and product promotions. While it takes time to grow a following, successful creators can generate significant income streams. Americans with unique skills, humor, or expertise are finding ways to connect with audiences and turn hobbies into businesses. The most profitable creators treat content creation like a career, focusing on consistency, branding, and engagement.

The Power of Passive Income

Passive income is one of the most desired financial goals among Americans. It means earning money with minimal ongoing effort after the initial work is done. Examples include royalties, rental income, dividends, and automated online businesses. While creating passive income streams requires effort upfront, the long-term benefits are immense. Many Americans use passive income to supplement their retirement savings or to gain financial freedom earlier in life. Building multiple streams of income creates stability and reduces dependence on one job.

Entrepreneurship and Startups

The United States has always been a land of entrepreneurs. From Silicon Valley startups to small local businesses, entrepreneurship remains a key way Americans build wealth. Starting a business does involve risks, but the potential rewards are high. Government programs, business loans, and angel investors provide funding opportunities for aspiring entrepreneurs. Success requires careful planning, market research, and persistence. For those willing to take calculated risks, entrepreneurship offers not only financial benefits but also independence and the chance to innovate.

Education and Skill Development

Earning more often depends on building valuable skills. In the U.S., industries like technology, healthcare, and finance offer high-paying careers for skilled professionals. Many Americans are returning to school, taking online courses, or earning certifications to stay competitive. Websites like Coursera, Udemy, and LinkedIn Learning make education affordable and flexible. Investing in yourself through skill development can open doors to promotions, career changes, and entrepreneurial opportunities. Knowledge is one of the best assets Americans can acquire in their financial journey.

Remote Work Opportunities

Remote work has expanded significantly in the United States, offering new ways to earn money without commuting. Jobs in tech, customer service, marketing, and design can now be done entirely online. Many Americans appreciate the flexibility of working from home, which saves both time and money. Remote opportunities also open doors for side hustles since people can better manage their schedules. As companies continue to embrace remote models, more Americans are building careers that balance financial growth with personal freedom.

Freelancing in the Digital Age

Freelancing has become a powerful career option in the U.S. With businesses increasingly outsourcing tasks, freelancers are in demand for writing, web design, marketing, and programming. Freelancing offers flexibility, higher income potential, and independence, though it also requires discipline and self-promotion. Websites like Upwork, Freelancer, and Toptal connect American workers with clients worldwide. By building strong reputations and networks, freelancers can create sustainable incomes. Many Americans are leaving traditional jobs to pursue freelancing full time because of the growing opportunities.

Investing in Retirement Accounts

One of the smartest financial moves Americans can make is contributing to retirement accounts. Employer-sponsored 401(k) plans often include matching contributions, which is essentially free money. Individual Retirement Accounts (IRAs) also provide tax advantages for savers. Starting early allows compounding growth to maximize retirement savings over decades. Too many Americans delay investing in retirement, leaving them unprepared later in life. By consistently contributing to retirement accounts, individuals can build financial security and ensure comfort when they stop working.

Real Estate Crowdfunding

Real estate crowdfunding is an emerging trend in the United States that allows individuals to invest in property projects without large upfront costs. Platforms like Fundrise and RealtyMogul let investors pool money together to finance real estate deals. This makes property investment more accessible to average Americans. Crowdfunding offers opportunities for both income and capital appreciation, though it also carries risks. With proper research, Americans can use crowdfunding to diversify their portfolios and participate in the real estate market affordably.

Building Credit Wisely

Credit plays a huge role in financial health in the U.S. A strong credit score affects everything from mortgage rates to job opportunities. Americans who manage their credit cards responsibly can unlock financial advantages, such as lower interest rates and access to better loans. The key is using credit strategically—keeping balances low, paying bills on time, and avoiding unnecessary debt. Building good credit early allows Americans to make bigger investments like homes or businesses with confidence and lower financial stress.

Saving and Investing in Real Assets

While digital investments are popular, real assets remain important for financial security. Americans often invest in gold, silver, or collectibles as a hedge against inflation. These assets can retain value even when markets fluctuate. Real assets also include land or small rental properties, which provide stability and potential appreciation. By diversifying into both financial and real assets, Americans protect themselves from market volatility. This balanced approach ensures long-term wealth protection and helps families weather economic downturns more effectively.

Tax Planning for Higher Savings

Taxes are a major expense for Americans, but smart tax planning can lead to higher savings. Deductions, credits, and retirement contributions can all reduce taxable income. Many individuals hire financial advisors or tax professionals to ensure they take advantage of available opportunities. Self-employed Americans especially benefit from tax planning, since they can deduct business expenses. By understanding tax laws and filing strategically, individuals keep more of their earnings and invest them toward financial growth. Tax planning is a wealth-building necessity.

Achieving Financial Independence

Financial independence is the ultimate goal for many Americans. It means having enough income from savings, investments, and passive streams to cover living expenses without relying on a traditional job. Movements like FIRE (Financial Independence, Retire Early) are gaining popularity in the U.S., inspiring people to save aggressively and invest wisely. While achieving financial independence requires discipline and sacrifice, the reward is total freedom. Many Americans dream of reaching a point where work is optional and life is truly theirs.

Final Thoughts

Earning and building financial stability in the United States requires more than just hard work—it requires strategy, planning, and persistence. From side hustles and gig work to investments and passive income, Americans have countless opportunities to grow wealth. The key is consistency: creating a budget, saving regularly, and investing wisely. By exploring multiple income streams and making informed choices, anyone can strengthen their financial future. With the right mindset and tools, financial freedom is within reach for every American.

Fashion in 2025 Self-Expression